Foram encontradas 120 questões.

Os polímeros sintéticos possuem características físicas, químicas, tipos de polimerização, métodos de manufaturação e aplicações diversas. No quadro abaixo, são mostrados APENAS os monômeros e os polímeros (I, II, III e IV) correspondentes.

Relacione os polímeros sintéticos I, II, III e IV com as características físico-químicas, tipo de polimerização e aplicação, respectivamente, mencionadas em P, Q, R e S.

I – Náilon

II – Teflon

III – Polietileno

IV – Poliuretanas

P – Inércia química, adição, isolamento elétrico

Q – Alta resistência à abrasão, adição, fibras

R – Alta resistência à umidade, adição, sacolas plásticas

S – Alta resistência à tração, condensação, fibras

A relação correta é:

Provas

Provas

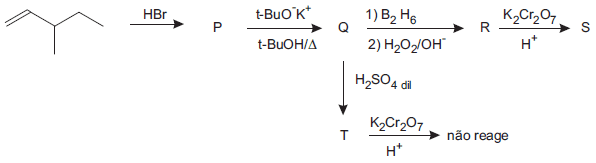

Na reação sequencial acima, a partir do 3-metil-1-penteno, formaram-se os produtos orgânicos P, Q, R, S e T. Nesta rota sintética, as substâncias P, Q, R e S são, respectivamente,

Provas

A pressão final de uma determinada massa de um gás ideal, se triplicado seu volume e reduzida sua temperatura a 1/4 da original, torna-se

Provas

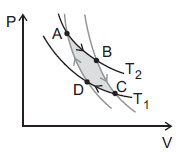

O ciclo de Carnot representado no diagrama P-V abaixo é constituído de duas transformações isotérmicas e de duas transformações adiabáticas, alternadamente.

Analisando esse ciclo na figura, conclui-se que

Provas

Para a reação de nitração de compostos aromáticos, utiliza-se uma mistura de ácido sulfúrico e ácido nítrico. Esses ácidos reagem entre si formando a espécie que reagirá com o anel aromático. Essa reação entre os ácidos sulfúrico e nítrico pode ser considerada uma reação ácido-base de Bronsted-Löwry?

Provas

Plantas de processamento primário de petróleo off-shore utilizam processos de separação gás/óleo/água. Para tal, são utilizados vasos separadores de grande volume, com tempos de residência em torno de cinco a dez minutos para os separadores trifásicos. O primeiro estágio de separação situa-se imediatamente a jusante do manifold de produção e realiza a separação das três fases: gás, óleo e água. A água efluente do separador é dirigida ao sistema convencional de tratamento de águas oleosas, antes de seu descarte ao mar.

Bol. téc. da Petrobras, Rio de Janeiro, 48 (1/2): 18 – 24, jan./jun. 2005.

(Adaptado)

Com relação aos processos de separação aplicáveis a esse sistema, foram feitas as afirmações a seguir.

I - A principal desvantagem do uso de hidrociclones no tratamento de águas oleosas é a alta sensibilidade a oscilações de carga.

II - A velocidade de entrada da carga no hidrociclone não interfere na eficiência de separação.

III - Para o primeiro estágio de separação da mistura trifásica, são utilizados separadores gravitacionais.

É correto o que se afirma em

Provas

Os ácidos naftênicos estão presentes em petróleos de diferentes origens, inclusive no petróleo brasileiro. O principal inconveniente causado pela presença desses ácidos é o ataque corrosivo aos equipamentos. Uma das alternativas para a remoção desses ácidos é a extração por solventes. Sobre essa operação unitária, foram feitas as considerações abaixo.

I - A utilização de modificadores capazes de alterar a relação solvente-diluente aumenta as perdas de solvente de extração por solubilidade no diluente.

II - A distribuição do soluto entre as fases pode ser governada pela equação xn = xonk, onde xn é o peso do soluto que permanece na fase a ser extraída, xo é a massa do soluto inicial, n é o número de extrações e k uma constante que envolve o coeficiente de distribuição.

III - Em misturadores-decantadores, quanto maior for a agitação, maior a transferência de massa; contudo, também será maior o risco de formação de emulsões.

IV - Para realizar extrações com dois líquidos de massas específicas muito próximas, pode-se lançar mão de uma centrífuga para acelerar o processo de separação das fases.

Estão corretas as considerações

Provas

Text II

The next oil giant?

Mar 19th 2009

From the Economist Intelligence Unit ViewsWire

Financing hurdles

At the time of the Tupi discovery, oil prices were close to US$100/b, but since then they have fallen to around US$40/b. Weak prospects for a significant pickup in the medium term have raised questions about whether investors will see the project as financially viable.

The drying up of international financing, significantly lower oil prices and the technological and geological challenges related to the development of the new oil finds make long-term cost calculations difficult.

Because of this, Petrobras decided to delay the announcement of its five-year strategic plan by four months. It was finally made public in February 2008 and included very ambitious financial goals. The revised plan for 2009-13 is based on an average oil price of US$42/b and calls for investments of around US$174.4bn, a 55% increase from the US$112.4bn stated in its 2008-12 investment plan.

Petrobras has gone some way towards securing financing for this year’s outlays. The company has raised US$10.5bn of the US$28.6bn it needs. Of the remaining US$18.1bn, it is set to receive US$11.9bn from the Banco Nacional de Desenvolvimento Econômico e Social (BNDES, Brazil’s national development bank) in the form of a 30-year US$11.9bn loan, with an additional US$5bn bridge loan expected from a consortium of international banks. Petrobras would need to raise a further US$10bn to cover its investments in 2010.

Growing difficulties in accessing international capital markets could scupper these plans or—at the very least—sharply raise the cost of borrowing. The brief easing of credit conditions in January allowed Petrobras to issue a 10-year, US$1.5bn bond on the eurobond market. But low risk appetite on the part of foreign investors, recent currency-derivatives losses and continued uncertainty regarding the value of the Real mean that large Brazilian companies are increasingly likely to rely on local banks for credit at high premium spreads.

What role for private capital?

While the role of the state oil company is not in question, the level and manner of participation by the private sector is not as clear. Brazil opened its hydrocarbons sector to private investors at the end of the 1990s. Since then, it has held annual bidding rounds that have become a model of transparency and have attracted large numbers of private participants.

However, Brazil’s new oil and gas potential has raised doubts about the extent of that openness in the future, as the government debates the preferred degree of private participation. Following the Tupi discovery, the government removed 41 deepwater blocks in the sub-salt region from the ninth bidding round for the first time since it started holding international rounds in 1998.

In 2008 Brasília again withheld offshore blocks from the 10th bidding round. Seven companies currently hold concessions for the development of the sub-salt: Petrobras, BG, Galp, Repsol, Shell, Exxon and Amerada Hess.

A specially created government task force is studying possible changes to the concession laws that would give Petrobras the upper hand in the development of the Tupi area. The task force is considering options such as raising taxes and royalties on private companies producing in the new areas. Under current concession contracts, private operators sell the oil they produce in exchange for a relatively low government take of between 5% and 10%. They also pay a special participation tax of 10-40% of revenue on large fields, depending on volume, location, depth and age; this level could also be raised. A more dramatic approach under consideration is to turn concession contracts into production-sharing agreements with Petrobras. This would mean that private companies would have to share their production with the government after recovering costs.

Any changes to the current contractual agreements would need congressional approval. But the final decision will be in the hands of the president, Luiz Inácio Lula da Silva, based on the suggestions made by the task force. Whichever line he takes will set the stage for hydrocarbons developments in a future oil-rich Brazil beyond the end of his presidential term in 2010. The government hopes that by engaging in a debate early on in the development of the south-eastern oil reserves, it will pre-empt a possible shift to resource nationalism.

THE ECONOMIST

http://www.economist.com/

displaystory.cfm?story_id=13348824&source=login_payBarrier

“I am a bit apprehensive of the temptation of relegating to the background the lofty and creative initiative of Brazil in the sugar cane-based ethanol and other biofuel energy products, the moment the drilling of these huge oil wells in Tupi and its satellite oil wells takes off in earnest, amid challenging circumstances, though. My advice is that while Brazil is joyfully tinkering with the prospect of raking in colossal petro-dollar money, she shouldn’t, by any means, lose sight of the need to consolidate investment in the already standard setting, functional, renewable and clean energy source that is the ethanol. The government should find a perfect mix in due course.”

Enyinnaya wrote

Mar 21st 2009

http://www.economist.com/node/13348824/comments

The author of the comment above expresses concern for the forecast presented in Text II since

Provas

Text II

The next oil giant?

Mar 19th 2009

From the Economist Intelligence Unit ViewsWire

Financing hurdles

At the time of the Tupi discovery, oil prices were close to US$100/b, but since then they have fallen to around US$40/b. Weak prospects for a significant pickup in the medium term have raised questions about whether investors will see the project as financially viable.

The drying up of international financing, significantly lower oil prices and the technological and geological challenges related to the development of the new oil finds make long-term cost calculations difficult.

Because of this, Petrobras decided to delay the announcement of its five-year strategic plan by four months. It was finally made public in February 2008 and included very ambitious financial goals. The revised plan for 2009-13 is based on an average oil price of US$42/b and calls for investments of around US$174.4bn, a 55% increase from the US$112.4bn stated in its 2008-12 investment plan.

Petrobras has gone some way towards securing financing for this year’s outlays. The company has raised US$10.5bn of the US$28.6bn it needs. Of the remaining US$18.1bn, it is set to receive US$11.9bn from the Banco Nacional de Desenvolvimento Econômico e Social (BNDES, Brazil’s national development bank) in the form of a 30-year US$11.9bn loan, with an additional US$5bn bridge loan expected from a consortium of international banks. Petrobras would need to raise a further US$10bn to cover its investments in 2010.

Growing difficulties in accessing international capital markets could scupper these plans or—at the very least—sharply raise the cost of borrowing. The brief easing of credit conditions in January allowed Petrobras to issue a 10-year, US$1.5bn bond on the eurobond market. But low risk appetite on the part of foreign investors, recent currency-derivatives losses and continued uncertainty regarding the value of the Real mean that large Brazilian companies are increasingly likely to rely on local banks for credit at high premium spreads.

What role for private capital?

While the role of the state oil company is not in question, the level and manner of participation by the private sector is not as clear. Brazil opened its hydrocarbons sector to private investors at the end of the 1990s. Since then, it has held annual bidding rounds that have become a model of transparency and have attracted large numbers of private participants.

However, Brazil’s new oil and gas potential has raised doubts about the extent of that openness in the future, as the government debates the preferred degree of private participation. Following the Tupi discovery, the government removed 41 deepwater blocks in the sub-salt region from the ninth bidding round for the first time since it started holding international rounds in 1998.

In 2008 Brasília again withheld offshore blocks from the 10th bidding round. Seven companies currently hold concessions for the development of the sub-salt: Petrobras, BG, Galp, Repsol, Shell, Exxon and Amerada Hess.

A specially created government task force is studying possible changes to the concession laws that would give Petrobras the upper hand in the development of the Tupi area. The task force is considering options such as raising taxes and royalties on private companies producing in the new areas. Under current concession contracts, private operators sell the oil they produce in exchange for a relatively low government take of between 5% and 10%. They also pay a special participation tax of 10-40% of revenue on large fields, depending on volume, location, depth and age; this level could also be raised. A more dramatic approach under consideration is to turn concession contracts into production-sharing agreements with Petrobras. This would mean that private companies would have to share their production with the government after recovering costs.

Any changes to the current contractual agreements would need congressional approval. But the final decision will be in the hands of the president, Luiz Inácio Lula da Silva, based on the suggestions made by the task force. Whichever line he takes will set the stage for hydrocarbons developments in a future oil-rich Brazil beyond the end of his presidential term in 2010. The government hopes that by engaging in a debate early on in the development of the south-eastern oil reserves, it will pre-empt a possible shift to resource nationalism.

THE ECONOMIST

http://www.economist.com/

displaystory.cfm?story_id=13348824&source=login_payBarrier

President Luiz Inácio Lula da Silva is mentioned in the last paragraph because, according to the author,

Provas

Caderno Container